The Lord of the Protocols from alphabanklog

The Lord of the Protocols

(An edited version of this article is published on Venture Beat.)

The crypto asset market has lost more than 85% of its market cap from its peak. But to me, a committed crypto entrepreneur, this is actually a good thing and the future of crypto looks more promising than ever. The craziness started by the ICO boom in 2017 had at least one strong positive impact — it introduced crypto into the mainstream and attracted many talented people into the crypto ecosystem. The crash will continue kicking out speculators and scammers, setting up a healthy market where investors search for real value. Thinking back and looking forward, now is a good time to reflect on where real value will be created and where the biggest value will be captured.

Crisis the crypto is in. Promising the future looks. Value we must create. — article author, a Yoda wannabe

Fat Protocols Revisited

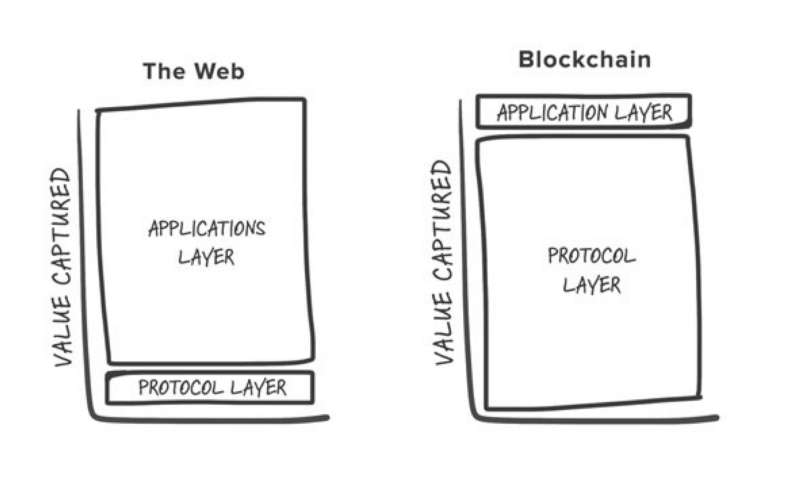

First introduced in August 2016, the Fat Protocols thesis argues that in the Internet technology stack, protocols created tremendous value but nearly all that value was captured by the web applications like Google, Facebook, and Amazon built on top of those protocols. In the blockchain technology stack, however, protocols not only create tremendous value but also capture most of that value, hence the Fat Protocols. It goes further to argue that “the market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer.”

Figure-1: Fat Protocols published in August 2016 (Source: USV blog)

While I agree that native protocol tokens fundamentally change the business models and via these tokens, protocols will capture most of the value they create, I believe the “Fat Protocols” thesis falls short by highlighting the “speculative value” of the token as a big reason for protocols to capture value, without articulating the dynamics of the token value during the bear market where speculation is gone. The protocols cannot be “fat” if the tokens do NOT have long-term, sustainable, non-speculative value. The Fat Protocols thesis can be improved by analyzing the impact of token economics, which is criticalin creating and capturing real value via tokens.

Token Economics Creates Long-term Value

Ultimately, the value captured by the protocols via tokens is the sum of long-term value and speculative value, which are the outputs of two functions Feand Fs which have token economics and speculation as inputs respectively. In honor of Fat Protocols, we can definite “value” as “FAT”. So we have a formula:

Given that right now only a few protocols like Bitcoin and Ethereum are actually being used and have Fe(token economics) value, most projects’ FAT is purely Fs(speculation) value. When the bear market comes (which we are in right now), the Fs(speculation) value mostly disappears. Hence it should not be a surprise that the value of a majority of tokens has gone to zero.

The Fe(token economics) value for protocol utility

tokens is mostly driven by token monetary policy — namely, token supply and token demand. Analyzing Bitcoin and Ethereum as examples, new tokens are minted into circulation in Bitcoin and Ethereum as block rewards to miners. However, everytime a block is produced, the native token demand (tokens required to use the protocol) which are the transaction fees, is much smaller than the block reward in monetary value. Hence, everytime a block is produced, there is a token oversupply which causes token value to go down from a token monetary policy point of view.

as for Bitcoin and Ethereum to appreciate in value, external (outside protocol usage) utility demand is required. For Bitcoin, which has achieved consensus at least among some crypto enthusiasts as a store of value, the external demand comes from the people who want to store their value in Bitcoin. For Ethereum, which is positioned as a developer platform, the external demand comes from protocols or applications built on top of the Ethereum. This difference in external token demand is key in understanding the value-drop from their peak values during this market crash in which Bitcoin only lost about 80% in value while Ethereum lost 90%+ in value.

After pivoting from payment currency to a store of value,

Bitcoin seems to have found a product market fit and the external demand seems to be solid enough to hold

up the value of Bitcoin. Unfortunately, protocols or applications built on top of Ethereum have not generated

a lot of external demand for Ethereum (MakerDAO CDP where Ethereum is locked is a good example of external demand of Ethereum).

In fact, most of them have incentives to create their tokens and use those tokens to capture as much value as

possible instead of passing value down to Ethereum beyond the required gas fees.

From a Fat Protocols thesis point of view, Bitcoin and Ethereum are the same, layer-1 infrastructure public blockchain protocol.

But from a token economics point of view,

they are different in that external demand in Bitcoin is more direct whereas external demand in Ethereum is more indirect,

and this subtle difference impacts the value of the protocol hugely. This opens up a very important question which is NOT

discussed in the Fat Protocols thesis: Which layer of the blockchain protocol stack will create and capture the most value?

The Lord of the Protocols

The layer of protocol that directly supports applications will create the most value and the native token of that protocol

will capture the most value. This protocol will rule all other protocols in the blockchain stack and become “The Lord of the Protocols”.

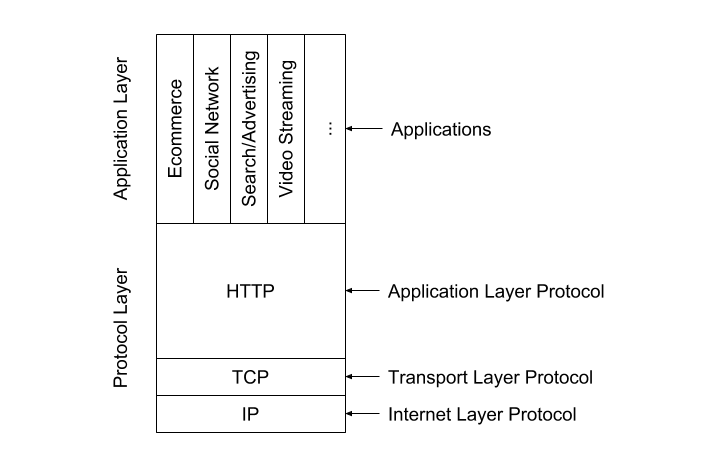

For a protocol in the blockchain stack to capture value via its native token, the protocol needs to create

value first. As shown in Figure-2, the application layer protocols create the most value in the Internet

stack even though they are built on top of lower layer protocols. This is clearly demonstrated by HTTP,

an application layer protocol. The HTTP layer unlocked the full value of the Internet, enabling the creation of

highly valuable businesses across ecommerce (Amazon), social networking (Facebook), search (Google), video streaming (Netflix), and thousands of other categories.

Figure-2: Application layer protocols (especially HTTP) create most value in the Internet stack

Most blockchain applications requiring a crypto token should not be built directly on top of a blockchain layer protocol such

as Ethereum. This is because the token used by the blockchain layer protocol is designed to secure and incentivize the

blockchain and thus cannot secure and incentivize the applications. Each application requires a dedicated, custom-designed

token and an associated middle layer protocol — a protocol on top of the blockchain layer protocol but below the customer facing application.

A middle layer will create value by powering a crypto network which will create a local economy in each application or business domain.

An economy always requires a currency to function and the protocol’s native token will act as the currency for the local economy

and capture a certain portion of the economic value accordingly.

Ultimately the middle layer protocols in the blockchain stack will create the most value, similar to the Internet stack. Unlike the Internet, though, the invention of the token allows the protocol to capture the value created rather than simply

providing a free standard upon which applications build their business models. The notable exception is that cryptocurrency like Bitcoin, a type of blockchain application, can be built directly on top of the blockchain layer protocol since the native token of the blockchain layer protocol is integrated with the application. In this case, it is still true that the protocol

immediately powering the application creates the most value.

The blockchain stack will be different from the Internet stack in that there will be many middle layer protocols instead

of a giant HTTP protocol to power most impactful applications. This is because each application or business domain

requires its own unique token economics design and hence a separate unique protocol to incorporate the token economics for each application.

Each of these middle-layer protocols captures the value of the staking, commission, and other protocol usage fees, in the same

way that blockchain layer protocols capture value (for example, the computational power provided by Ethereum). The

economy created by that incentivized, differentiated middle-layer protocol stands to be much larger than the economy

created by the more commoditized, computation-driven blockchain protocol layer. In fact, I predict that a few of these

protocols tied to larger application categories like commerce and social networking will create decentralized local

economies that are more than $100 trillion in size, with the tokens in those few protocols capturing massive value much

bigger than any blockchain layer token, including the leading cryptocurrency Bitcoin.

Conclusion

The 2018 crypto crash has filtered out speculators and scammers and established a healthy market environment for committed entrepreneurs to

create real value. For a token-based project, token economics is critical to create long-term, sustainable, non-speculative value and capture

most of the value via tokens. Similar to the Internet stack, the middle-layer protocols in the blockchain stack that directly support the

applications will create the most value, but unlike the evolution of the Internet, the native tokens of these protocols allow them to capture

that value. With well-designed token economics, the crypto network powered by a few of these middle-layer protocols will create

decentralized local economies that are more than $100T in size. By capturing this value, each of these middle-layer protocols will

establish themselves as a “Lord of the Protocols.”

You can also buy instant:

Cashapp Money Transfer Click here

Paypal Money Transfer Click here

Western Union Money Transfer Click here

Venmo Money Transfer Click here

Bank Money Transfer Click here to Contact Us